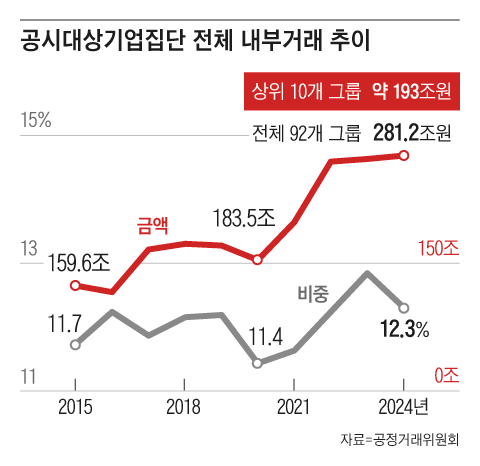

According to a report, the internal transaction volume among affiliates of South Korea’s top 10 conglomerates amounted to 193 trillion won last year. Coupang, which has recently been involved in a controversy regarding a personal data breach, accounted for roughly 26% of its overall sales through dealings with affiliated companies, with the share of internal transactions increasing significantly over the past year.

As per the “2025 Analysis of Internal Transactions in Publicly Disclosed Business Groups” report published on the 3rd by the Korea Fair Trade Commission (KFTC), the internal transaction volume of the top 10 groups with controlling shareholders reached about 193 trillion won last year, up by roughly 1 trillion won compared to the previous year. This represents 69% of the overall internal transaction amount (281 trillion won) across all publicly reported groups. The rise in internal transactions signifies the first increase in two years.

◇ Coupang’s Internal Transactions Increase by 3.6 Percentage Points Over the Past Year

Of the 92 publicly announced groups, Daebang Construction had the largest share of internal transactions at 32.9%, followed by Jungang with 28.3%, POSCO at 27.5%, BS with 25.9%, and Coupang at 25.8%. Coupang experienced the second-highest increase in internal transaction ratio, climbing by 3.6 percentage points from the prior year, after Semando Holdings, which saw a rise of 7.1 percentage points. Coupang derives over a quarter of its revenue from transactions with affiliated companies because of its vertically integrated logistics, delivery, and payment systems.

Several groups experienced notable rises in the share of internal transactions during the last ten years, such as HD Hyundai (an increase of 7.0 percentage points) and Hanwha (a rise of 4.6 percentage points). HD Hyundai’s approach to minimize supply chain risks via business divestitures and Hanwha’s expansion of internal transactions during the addition of new subsidiaries and corporate reorganization were mentioned as contributing factors. On the other hand, LG saw a decrease of 7.3 percentage points, and Lotte experienced a drop of 2.4 percentage points.

◇ Greater Influence of Major Shareholder, Increased Internal Transactions

A distinct pattern became evident: the larger the controlling family’s ownership share, the more internal transactions occurred. In the previous year, companies with a controlling family ownership of 20% or more had an internal transaction rate of 10.9%, whereas those with 30% or more reached 14.5%, 50% or more hit 18.3%, and those with 100% had 24.6%. Interestingly, families in which the second generation held a 50% or higher stake experienced a significant rise in internal transactions beginning in 2022. A KFTC representative stated, “This could be linked to the transfer of management control.”

Trademark rights have also emerged as a significant income generator for influential families. The number of groups collecting trademark fees from affiliated entities has risen for five straight years, reaching 72 last year—26 more than in 2020. Trademark income also rose by almost 60% to 2.1529 trillion won. Seven companies—LG, SK, Hanwha, CJ, POSCO, Lotte, and GS—each received annual trademark payments over 100 billion won, with their total transactions amounting to 1.3433 trillion won, making up 62.4% of the overall figure.

Firms where a controlling family holds 20% or more equity received 81.8% of the group’s trademark usage fees. The KFTC noted, “Trademark dealings indicate strong connections with controlling families and necessitate ongoing oversight.”